A new ING presentation fleshes out and updates the argument set out in the previous ‘Warped World’ report (see below):

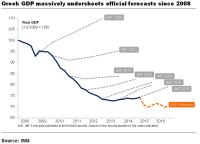

- Forecasters are struggling to cope with heightened political and policy risk (the recent reaction to the ECB’s rhetorical flourishes being a case in point)

- Consensus forecasts for long term growth in the US and Eurozone have been downgraded by only 0.3% or so – trivial in relation to the sustained growth downturn that Japan has experienced, and hard to reconcile with the 300 basis point decline in government bond yields since the crisis began.

- Suddenly corporate bonds don’t look so risky – in Spain and Italy multinationals are borrowing more cheaply than their home governments, breaking the ‘sovereign ceiling’.

- Financial repression is illustrated by the rapid localisation of holdings in the Eurozone bond markets, particularly by banks.

- The power of ‘safe haven’ flows is shown by the plunge in bond yields into negative territory in markets such as Germany, Switzerland and Denmark.

- Moreover, the US Treasury bond market has been a magnet for foreign private investors. This is despite the US credit rating downgrade last year and the handwringing over whether US politicians will come up with more plausible long term fiscal consolidation plans.

To see the presentation click on the banner to the right.